Table of Contents

- Introduction

- Best Online Payment Systems

- 1. PayPal

- 2. Amazon Pay

- 3. Braintree

- 4. Dwolla

- 5. SecurePay

- 6. CyberSource

- 7. Elavon Converge

- 8. Stripe

- 9. Google Pay

- 10. Nochex

- 11. Due

- 12. Adyen

- 13. GoCardless

- 14. X-Payments

- 15. Authorize.net

- 16. Worldpay

- 17. Popmoney

- 18. Shopify

- 19. Square

- 20. Wave

- 21. Digital River

- 22. Charge.com

- 23. PayXpert

- 24. Verifone

- 25. Clover

- 26. Flint

- 27. WePay

- 28. Heartland Payment Systems

- 29. ecoPayz

- 30. Intuit GoPayment

- 31. Neteller

- 32. Payoneer

- 33. Payline Data

- 34. Skrill

- 35. Moneris Solutions

- 36. Apple Pay

- 37. Venmo

- Conclusion

Introduction

The year 2021 has faced its share of turbulence.

This was the year of the ‘Great Reshuffle’, or, as the rebellions that aren’t happy with their crappy jobs put it, the ‘Great Resignation’.

Among many, one of the major reasons for several individuals to leave their jobs was the realization that you don’t need to sit in an office to make handsome money.

The online world is filled with money-making opportunities today that must be grabbed.

From being a freelancer in different fields (like copywriting, graphic designing, or even consultancy) to starting an eCommerce website to sell products like homeware or apparel, from creating an online course in your area of expertise to starting a blog for affiliate marketing, there are tons of ways for you to make money online.

Additionally, if you have a tangible business, you can take it online to reach a wider audience and boost up your sales.

Whatever you decide to do, there is one common thing that you will definitely need, irrespective of the online journey you embark on – a safe, secure, and reliable online payment solution.

You will be billing your customers for your products or services and getting those bills paid is of utmost importance. Thankfully, with the advancement of technology, there are online payment platforms in overabundance today.

We have compiled a list of the top-rated ones below.

But before we move further to the list, let’s first understand a few features that you must look for when choosing between different website payment options. These features are:

- – Safety and security

- – Ease of integration

- – Multiple payment options

- – Fast processing speed

Best Online Payment Systems

Here are the most commonly used payment systems that several online businesses are using in today’s time and date.

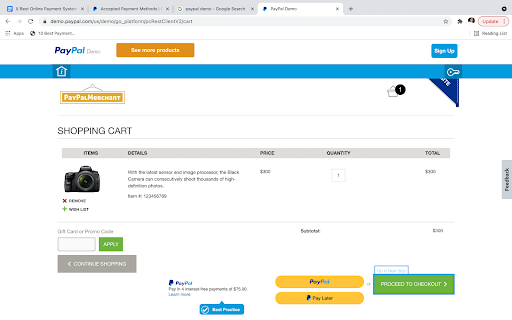

1. PayPal

PayPal is the most widely used online payment system. The net payment volume that was processed by PayPal in the second quarter of 2021 was 311 billion U.S. dollars, making it the leading online payment service.

If a user has an account on the PayPal platform, the payment can be made either using an email address or with the help of a credit/debit card. The former feature often prompts the user to create an account on this payment platform.

The best thing about PayPal is that you don’t need to face high transaction/monthly costs that come with credit card payments.

Additionally, a PayPal user has the ability to withdraw money from approximately 56 different countries for a minimal fee.

Today, PayPal has also started accepting payments in the form of cryptocurrency, allowing users to use bitcoins or ethereum to pay for their purchases.

Pricing: While there is no setup cost, PayPal charges 4.4% + a fixed fee for international transactions and 2.9% + $0.30/transaction for US transactions.

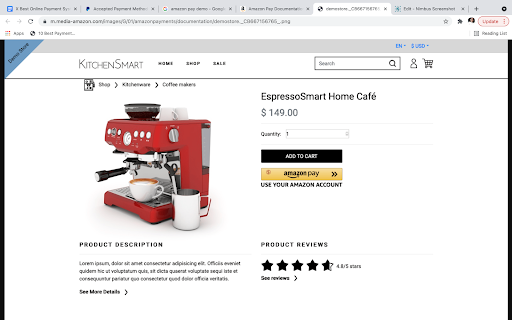

2. Amazon Pay

Amazon Pay is among the online payment options that are extremely easy to use and understand. With features like Amazon Alexa, your customers can use their voice to make payments online, which makes it an inclusive payment option.

Along with this, the customers can make use of the payment methods that have already been saved in their Amazon account. They don’t have to go through the hassles of re-entering their details.

Amazon Pay is very easy to set up. Its mobile-friendly interface makes it a hit among the shoppers that use their smartphones to shop online.

To add to that, this is one of the most commonly used eCommerce payment solutions that is being used by the leading merchants in the online shopping industry.

This is also an extremely useful payment option if you have to charge a monthly fee from your customers.

Pricing: There is no setup fee. However, Amazon Pay charges a minimal transaction fee i.e. 2.9% + $0.30/transaction.

3. Braintree

Used by popular websites like StubHub, Uber, and Airbnb, Braintree is an online payment platform that was acquired by PayPal back in the year of 2013.

Braintree is backed by a state-of-the-art fraud detection feature that allows merchants to instill trust among their customers, which is extremely important to make sure the leads are being converted into paying customers.

What makes Braintree fall among the best online payment providers is the ease of integration. By means of this, shoppers can use different and their preferred payment methods to make the purchase. This includes Venmo, Google Pay, Amazon Pay, debit cards, and credit cards.

Braintree is a choice of platform for those looking for a seamless experience. It can be customized according to the needs of the merchants, and hence, is perfect for businesses with high sales volume.

Pricing: Just like PayPal, Braintree doesn’t charge any set-up or monthly fee. It only charges a transaction fee of 2.9% + $0.30/transaction.

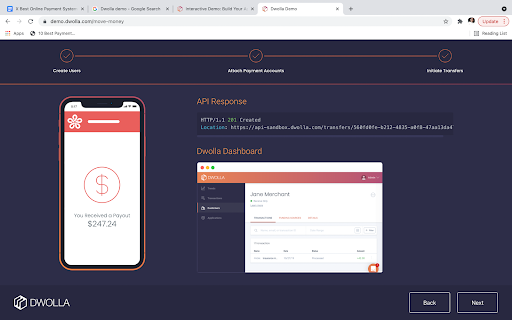

4. Dwolla

Dwolla is another one of the top online payment solutions for businesses, however, just in the USA. It specifically links to the US credit union/bank accounts.

Dwolla is a domestic payment solution that is famous for its safety and simplicity. The user interface of this platform is intuitive and can be customized according to the needs of the business.

Whether you have a business that needs to accept payment in bulk or you conduct single transactions, Dwolla is a payment solution that you can rely on. You can send around 500 payments in a single transaction.

With Dwolla, you can also transact same-day ACH payments.

Pricing: There is a 0.5% fee per transfer. Dwolla also offers flat monthly pricing options starting at $250, going up to $2000. The customer onboarding fee is $1-$2 per customer.

5. SecurePay

SecurePay is an eCommerce payment system that is popular among those doing business in the country of Australia.

This payment platform is a product of Australia Post, which is a postal service enterprise owned by the government. SecurePay is recognized for its flexibility and security.

If you are in Australia, SecurePay should be your choice of the payment system, owing to its seamless integration feature.

The tool also provides you with a dashboard that you can use to access detailed reports on your everyday online transactions. This feature makes it easy for you to balance your financial accounts every month.

You can also customize SecurePay according to your business and personal needs.

Pricing: There is no setup/hidden fee involved. However, SecurePay does work on a per-transaction fee pricing model. In the standard pricing model, 1.75% + $0.30 AUD is the fee on domestic cards and 2.90% + $0.30 AUD on international cards. Customization charges are extra.

6. CyberSource

With more than 300 fraud detectors in place, CyberSource perhaps offers the safest and most risk-free electronic payment services.

This trailblazing platform comes equipped with plenty of useful features that not only make the payments quick but also flexible.

The main aim of CyberSource is to help businesses worry less about their payment gateways and focus more on scaling their businesses. To ensure the same, the company provides customer-friendly payment solutions, easy integrations, and 24/7 support.

You can find CyberSource serving approximately 190 countries. It allows businesses to transact in 40 different currencies across the globe.

Their digital-first approach allows businesses to store sensitive information such as card details in secure and safe Visa data centers.

Pricing: The company offers a custom payment program for businesses, it doesn’t offer any form of flat pricing model.

7. Elavon Converge

Elavon Converge is a blessing in disguise for eCommerce websites. This platform makes eCommerce payments straightforward and user-friendly.

This omnicommerce payment solution allows businesses to accept payments from customers that are paying online, in-store, or via smartphones.

The scalability feature of Elavon Converge provides businesses with flexibility and the ability to grow, without worrying about changing the payment channels.

The simple checkout process makes this payment platform customer-friendly, thus adding to a positive customer experience. The tool also offers multiple methods to collect payments including buy buttons, invoicing, and integration with digital wallets.

You can also extract transaction reports to keep track of your finances.

Pricing: For the pricing options, the business is needed to request a call back from the company. They will provide an estimate according to the customizations that the business will opt for.

8. Stripe

Primarily created for web developers that are looking to customize their bill payment systems, Stripe is an excellent option that is backed by a powerful API.

You don’t have to necessarily opt for customizations because Stripe also provides a standardized platform that is equipped with potent features. These include recurring payments, mobile payments for different operating systems such as Android and iOS, intuitive checkout flow, and the ability to include your discount/sales coupons.

The fraud management tool provided by Stripe is named Stripe Radar. This feature ensures that all payments are made safely, thus instilling trust among the customers.

Stripe has proven to be effective for those businesses looking for custom online payment portals.

Also, Stripe accepts payments in 135+ currencies to make it easy for your international customers to pay for your products and services.

Pricing: There is no setup/hidden cost. You pay only for the features that you use with Stripe. There is a 2.9% + 30¢ per successful card charge.

9. Google Pay

GooglePay is a popular free payment processor that is gaining fame owing to its convenience and adaptability.

Today, Google is the most popular search engine with 86.64 percent of the market share by September 2021. Google Pay is the payment platform that is connected to the user’s Google account, making it among the most hassle-free forms of making payments.

If your user opts for Google Pay as their payment method, all they need to do is log in to their account, go to the payment request, and make the payment by adding a 4 to 6 digit PIN.

Its simplicity makes it an extremely effective and efficient method.

Pricing: There is no setup fee or transaction fee that Google Pay charges.

10. Nochex

Nochex is a website payment processing system that is supported by most of the eCommerce platforms that are in the market today.

Nochex is a U.K.-based company that was primarily created to help businesses in the United Kingdom do business with international and domestic clients.

With Nochex, businesses can take online payments from all the major credit and debit card companies across the globe.

What sets Nochex apart is its ability to help you personalize your payment processing solutions for your customers. By offering telephone payments, online payments, and invoice payment options, this platform helps businesses add a personal touch to their service.

Nochex has helped several schools, charities, takeaways, and clubs, among other businesses, to make their payments faultless.

Pricing: The platform follows a pay-as-you-go pricing model with a 2.9% + 20p fee.

11. Due

Due is not only an online payment company. It is a complete solution offering time-management and invoicing features, which makes it an excellent platform for freelancers and small business owners. Primarily, Due is a platform for the B2B segment.

It offers different payment modes including ACH payments, plastic money payments, and even provides an option of integrating different payment platforms like Stripe and PayPal.

Due is well-known for being a payment platform that provides end-to-end solutions and allows you to access all your payment information in just one location.

There is also an option of e-bank. This e-bank allows you to store your cash online. With this band, you can make a payment without having to enter your account details every time you make a transaction.

Pricing: The platform charges a 2.7 percent transaction fee for credit card processing.

12. Adyen

Adyen gained its popularity when it was adopted by two of the most popular brands named Microsoft and Spotify.

Adyen is a payment system that has been specifically designed to escalate growth. This tool was built for all kinds of businesses, irrespective of the size and industry, and for all phases of the customer journey.

With Adyen, you can give your customers an option to choose their preferred payment channel. It could be in-store, online, or even in the mobile application, no matter where they are across the globe.

This payment platform accepts payments with a digital wallet, credit and debit cards, and other digital channels.

Adyen has a powerful risk management feature where it deploys a data-driven approach to block any fraudulent activity.

Businesses also get in-depth reports and insights that allow them to make informed and intuitive decisions.

Pricing: Adyen charges a processing and per-transaction fee for different payment methods. Click here to check out the transaction fee models.

13. GoCardless

GoCardless is a payment platform that has been primarily designed for businesses with a recurring payment model. Of course, it offers a one-off payment as well, but it’s targeted towards those businesses that are in search of a platform that makes collecting recurring payments seamless.

GoCardless ensures that you are not running behind your customers, asking for payments. Instead, they can authorize an automatic debit of payments on due dates by simply completing an easy digital payment form.

This platform is an answer to those debit and credit card payments that often fail because of mishaps such as the card being stolen or expired. In case someone does experience a failed payment, this tool is equipped to send alerts to the business that can then take steps to avert the crisis.

Pricing: While there isn’t any setup cost, the platform does charge a nominal transaction fee. For the UK and Eurozone, the fee is 1% + £/€ 0.20 per transaction, and for international payments, the fee is 2% + £0.20 per transaction.

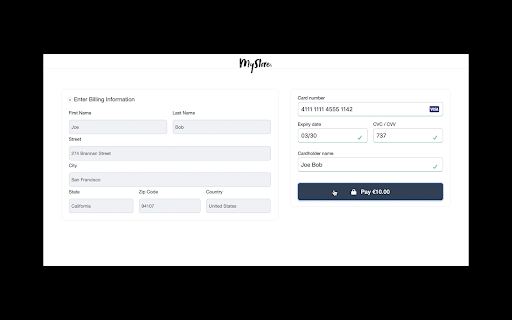

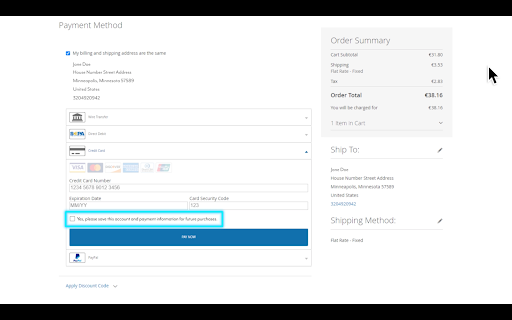

14. X-Payments

X-Payments is known for its ability to provide unmatchable financial safety and privacy. It is a PCI level 1 certified platform, which means it has cleared the Payment Card Industry Data Security Standard.

It is among the safest eCommerce payment platforms that keep the credit card information of your customers protected at all times.

X-Payments allows your customers to make the payment on the webshop they are purchasing from, they don’t have to leave your store to make the payment.

Moreover, X-Payments guarantees its compliance with the security mandates specified by PCI, thus saving you from paying penalties that can be as high as $5000.

Pricing: The platform offers payment packets according to the number of transactions that take place on your website per year. You can find the same here.

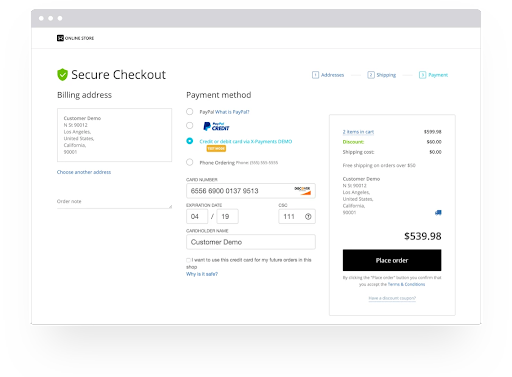

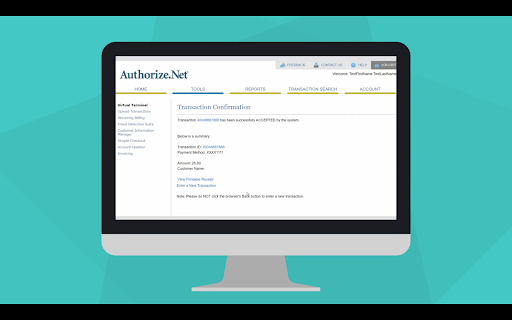

15. Authorize.net

If you are looking for an effective and incredible solution for online payment collection for your eCommerce business, should certainly be in the running.

This payment platform by Visa has been around for more than two decades now. It is among the widely used payment solutions that handle more than a billion transactions on a yearly basis in today’s time and date.

When making a payment, your customers do not have to leave your store and head to a third-party site, which adds to your credibility as a brand.

Authorize.net offers integrations with different payment channels including ACH payments, credit cards, and digital wallets like Apple Pay or PayPal.

The platform also offers a recurring payment option that can help reduce failed transactions and ensure your payments are being processed correctly.

Pricing: Authorize.net charges a $49 setup fee, $25 monthly gateway fee, and 2.9% + $0.30 per transaction fee.

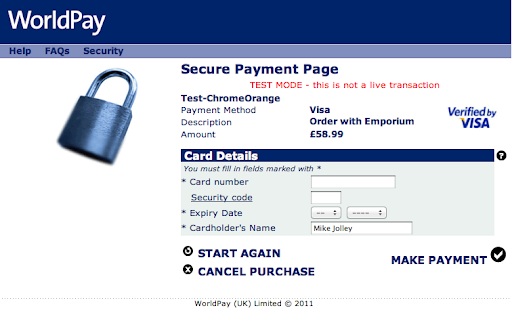

16. Worldpay

Worldpay is considered to be U.K.’s one of the top online payment service providers that process approximately 26 million transactions per year.

The platform offers a faster, safer, and more convenient way to accept payments for online products and services offered by a business.

This online payment solution offers both online and mobile payment processing options to customers. They can choose their preferred payment method, which adds to the overall user experience.

The users of Worldpay are provided with access to the dashboard that allows them to keep track of the orders they are receiving. Moreover, this platform also makes it easy for you to refund the money to the customers. All that’s needed to do is press one button and the refund will be processed.

Worldpay is a platform of choice for more than 250,000 small to medium businesses in the United Kingdom itself.

Pricing: The platform charges £19 per month for standard gateway and £45 per month for advanced gateway.

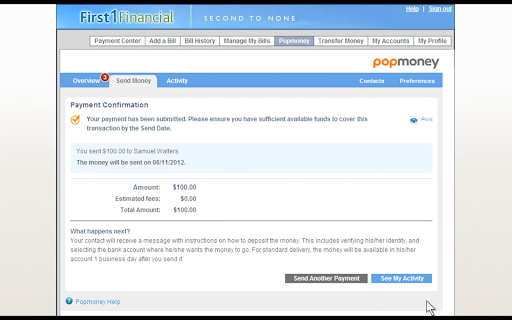

17. Popmoney

Just like Dwolla, Popmoney is a solution used to make payments online in the USA. This US-based platform allows businesses to receive, send, and request money from US bank accounts/debit cards.

One thing that must be considered is that Popmoney is useful for businesses that deal in smaller transactions. This is because this platform allows only a limited amount of money to be transferred or received on a daily or monthly basis.

With Popmoney, you can receive money directly from a bank account to your bank account. There is no middle platform where your money can get stuck for days.

Pricing: Popmoney charges a flat $0.95 per transaction fee.

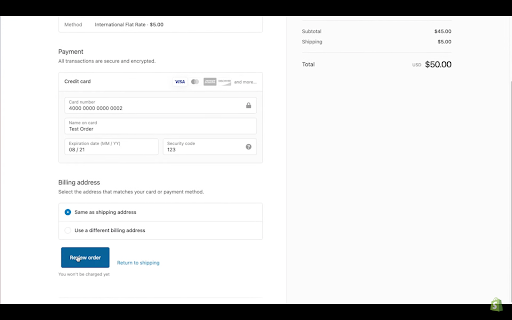

18. Shopify

If you have an eCommerce business (or not), you probably have already heard of the eCommerce platform named Shopify. It is among the most popular platforms that have made creating and managing an eCommerce website a cakewalk.

With the help of Shopify payment services, you can easily offer your customers a choice between paying online and in-store.

The best thing about Shopify that makes it an ideal payment platform for online stores is its ability to sync your sales with the payments that are made. This means that you can track your inventory and do an analysis of your sales data easily and conveniently.

Apart from being an excellent payment system, it is also an extremely equipped eCommerce platform that allows you to integrate your other features to your website such as your social platforms, Amazon account, Quickbooks, and more.

Pricing: Shopify charges a 2.0% transaction fee.

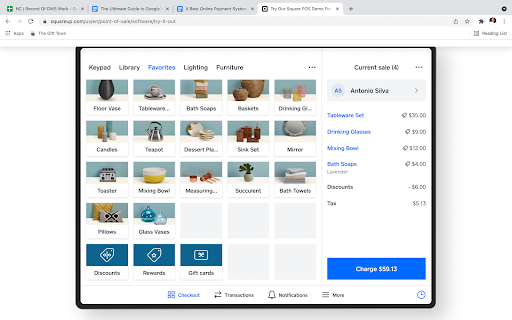

19. Square

Thanks to its innovative magstripe reader, Square is now a part of some of the best online payment methods. This mobile card reader allows your customers to swipe credit cards from anywhere in the world. What sets this credit card company apart from its competitors is its nominal transaction fee.

This is perhaps the most versatile online payment system that has been designed for small businesses. With the help of this tool, you can convert your smartphone or your tablet into a POS machine.

By adopting Square App, you can easily customize your payment register and issue invoices for your products or services. To add to that, this tool also allows you to manage your timesheets and track your inventory, which makes it a superb option for eCommerce businesses.

This is a complete, one-stop solution for small and large businesses alike.

Pricing: While the mobile card reader is free, their premium version named Square Stand is for $99. The platform also charges 2.75% per swipe for credit cards.

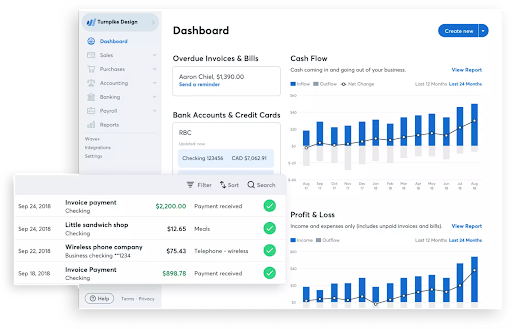

20. Wave

Wave is a bookkeeping and online payments solution for small and medium enterprises.

Apart from accepting payments and creating invoices that look extremely professional, you can also use this tool to track your accounts and release the salaries of your employees.

With the help of the invoice software of Wave, you can also provide recurring billing and give the option of automatic payments to your customers.

This financial software is also an excellent tool to obtain funding for small businesses.

Pricing: This is free software with no setup costs, monthly costs, or any other hidden costs.

21. Digital River

Digital River is a platform that is specifically designed to help businesses build their very own D2C channel. The tool can be customized to meet your needs and align with your business goals.

As a global online payment platform, Digital River has partnered with the leading names in the payment processing, fintech, and gateway industries.

Digital River helps reduce the global merchant processing fees and boost up the authorization rates. All this is done through leveraging their local entities and expansive network.

Their hyper-localized approach allows your business to offer your customers an option to choose their local preferred mode of payment. This payment preference varies with the country, which further helps diminish cart abandonment rates.

You don’t need to be tech-savvy to integrate this tool into your website. You can make use of drop-in integration and update your checkout easily. It also offers language localization, thus further making the tool inclusive.

Pricing: The pricing model depends on your customizing needs. You can get the quote by giving a call to this online payment processing company.

22. Charge.com

Charge.com is a well-known credit card processing company. It is a platform that allows businesses to accept payment via credit cards easily and securely.

This platform has been a part of the industry for more than 25 years now. Over the years, it has been ranked as the number one merchant account provider six times in a row.

It allows you to accept payments using different credit card brands such as Visa, MasterCard, Discover, and Amex. You can use different channels to process payments such as online, by mail, by phone/fax, or even in person.

Its fast setup with no additional charges makes it a popular payment platform among merchants across the world.

Pricing: Click here to check the pricing breakdown of Charge.com.

23. PayXpert

Offering a hassle-free and painless way to make payments is an integral part of improving the overall customer experience, and PayXpert helps you achieve precisely that.

PayXpert is an internet payment solution that allows you to accept payments across different channels and in whatever form your customers find comfortable. With the help of this feature, your customers can use the channel they often use.

You can accept payments online, in-store, or even in-app, irrespective of where your customer is across the world.

If you have certain business requirements, you can easily tailor this payment platform as per your needs.

In addition, you can get in-depth information and insights on what your customers truly want with the help of detailed reports provided by the tool.

The tool also offers features like one-click payments, recurring billing, and a dedicated expert manager, making it reliable software.

Pricing: There is no setup fee.

24. Verifone

Previously known as 2Checkout, Verifone is among the most trusted online payment systems. Verifone acquired 2Checkout back in 2020.

This is a platform that allows businesses to accept payments in different types including digital wallets, credit cards, debit cards, or even bitcoin!

Verifone provides options for choosing between online payment platforms and mobile payment platforms.

What makes Verifone a highly reliable platform is that it started off as point-of-sale hardware before entering the software application sector.

Verifone offers features that allow businesses to handle their commerce operations easily. This includes billing, payment, and subscription management.

Pricing: There is no setup cost. The platform charges flat 2.9% + $0.30 per transaction.

25. Clover

If you are a business that is in need of typical point-of-sale payment tools, Clover is your best bet. This is a payment platform with an App marketplace that comes filled to the brim with applications that can help optimize your business payment processing.

From Quickbooks to tools that help you collect customer feedback, you can find Clover helping you with a lot more than just accepting or making payments.

This accounting software can bring all your business operations in one place. So much so, that you can even use an app to drop a text to an employee who’s late. Or, you can use the feature where the app will ping you in case you have an important event coming up.

Coming back to the POS solution, Clover offers you four different options to choose from. These include Clover Mini, Clover Go, Clover Mobile, and Clover Station.

You can choose your version depending on your business type. With all the versions, you can accept multiple forms of payment, so you don’t have to worry about that.

Pricing: To get the quote, you will need to connect with their sales team.

26. Flint

Flint is an eCommerce payment system that is ideal for those who prefer accepting payments on their smartphones.

Flint is a mobile application that can easily and securely scan your customer’s credit card data. You don’t require any dongle or any attachments to access this tool, which makes it a convenient undertaking for many.

With the help of Flint, businesses are free to choose their method of payment. They can accept payment online, in cash or checks, and are also free to create and send invoices or coupons to their customers using their email addressesmulti-pricing.

Pricing: Flint charges 2.9 percent + .30¢ per transaction for online sales.

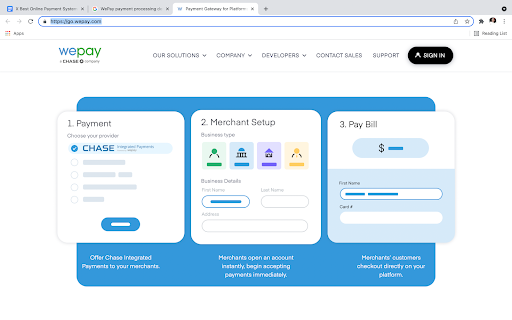

27. WePay

WePay is an online payment acceptance system that prides itself on its excellent customer service. This is a payment solution that is well-known for its safe and secure payment processing, all thanks to its fraud detection and protection feature.

With WePay, you can ensure that your customers are not required to leave your site and head to a third-party domain to make the payment. This characteristic feature of the tool makes your business look more credible and reliable.

You can even customize the tool according to your needs and align your payment processing with your business goals. You can completely change the look and feel of your checkout page to make it look like a part of your business website.

By adding the brand elements to your checkout page, it will add to your branding efforts.

Moreover, you can also make changes to your customer support emails, confirmation emails, mobile transactions, and credit card statements to add your brand elements to these assets.

In addition, thanks to its mobile card reader, you can provide your customers with a single mobile app that offers on-the-go payment ability to them. This helps make the overall experience of the user much better.

Pricing: Contact their sales team to get a quote based on your customization needs.

28. Heartland Payment Systems

With its main focus on transparency, effective customer service, and reliable security, Heartland Payment Systems is among the best payments solutions providers across the world today.

Whether it’s a secondary business or an entrepreneur’s dream company, this payment system has caught the attention of businesses across industries.

Heartland’s next-day funding feature is what makes it one of the top systems that businesses are adopting today.

This is a cloud-based system that provides versatility to entrepreneurs. With its wide variety of hardware options, you can rely on Heartland for your accounting business needs.

From credit cards and online payments to gift cards, digital wallets, in-store payment, or EMV chip payment, Heartland offers quick and reliable payment processing at nominal and transparent rates.

Pricing: You will be required to get in touch with the company to get your quotations.

29. ecoPayz

It is crucial for online businesses to choose their payment processing system wisely. One feature that is a must is safety and security, and ecoPayz offers precisely that.

ecoPayz is a software that is perfect for receiving payment online. When you create an account on this payment portal website, you can send and receive money from anywhere in the world.

You don’t need your bank account or credit cards to open this free account. The payment system uses only the latest fraud detection technology to keep your transactions quick and safe at all times.

By using the method called ‘safeguarding’, ecoPayz keeps their money separate from your own. This way, your money is protected, no matter what.

You also get a contactless Mastercard that allows you to make ATM withdrawals or receive money from every country/city across the globe.

Pricing: You can check out this link to find out about the different pricing plans that ecoPayz has to offer.

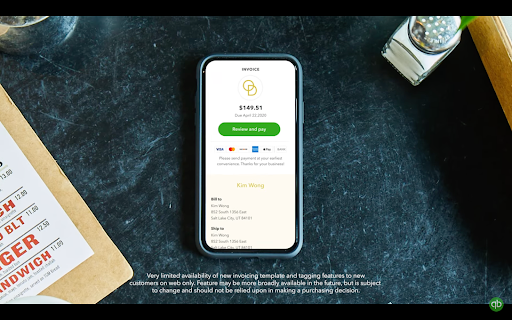

30. Intuit GoPayment

If flexibility and speed are what you are looking for in your gateway services for web payment, then Intuit GoPayment by Quickbooks is perhaps the best online payment processor for you.

With Intuit GoPayment, you get a lot more than a mobile credit card processor that allows you to accept both in-store and online payments. This is also a tool that is considered perfect to help businesses manage their payrolls and calculate taxes.

GoPayment is also an ideal choice of payment processing software for those who wish to provide their customers with utmost convenience. This is because apart from a card reader, this also allows you to accept payments from wallets like GooglePay and ApplePay.

To ensure the safety of your data, Intuit GoPayment has an additional layer of security added to each transaction.

The best thing about this payment tool is the customer support you get. Whether you have a complaint or you need help with setting up your account, the customer service professionals in this company are always ready to help. This makes it among the most reliable and credible brands to work with.

Pricing: Their pricing model starts from $25/mo and goes up to $180/mo.

31. Neteller

For those entrepreneurs who manage businesses overseas, Neteller is a perfect choice. Neteller provides one of the safest online payment processing services that help instill trust among your clients, helping you improve your conversion rates.

With the help of this digital wallet, you can make your payment processes not only safe but also quick. This adds to your overall customer experience, making it better, one dollar at a time.

What sets Neteller apart is its zero fees on transactions that take place using a debit card. This helps save money and keep the sale prices on the lower end, allowing your customers to enjoy your actual rates.

Another feature that Neteller provides is the ability to trade cryptocurrencies. It offers around 100 different ways for you to buy/sell twenty-eight different cryptocurrencies including Etherum, Bitcoin, and more.

For online payments using debit/credit cards and digital wallets, Netteler supports 22 currencies, making international transactions accessible.

Pricing: There is no setup or hidden fees. Neteller charges a 2.5% transaction fee on credit card transactions.

32. Payoneer

Falling in the list of one of the oldest online payments companies, Payoneer allows companies to conduct business transactions on a global level.

Payoneer is considered one of the best partners for running an online business. Whether you are a freelance service provider, an eCommerce company, or a digital marketing agency, Payoneer is accepted worldwide as the go-to partner for scaling up your business.

If you have a business abroad, you can get a bank account number of that location and accept payments from the locals in that particular account. This makes it easier for the locals to put their faith in you and consequently, makes your business look more credible.

This payment processor also offers the most helpful customer service team that further simplifies the use of this tool.

Pricing: Payoneer charges 3% on credit card transactions, irrespective of the currency, and 1% on ACH Bank Debits.

33. Payline Data

Payline Data is among the top credit card and debit card companies in the world. This tool is known for offering the safest online payment method to small and medium-scale businesses.

Payline Data is perfect for accepting online payments because it offers easy integrations of the tool with the shopping carts on your website.

The next-day funding also allows you to accept payments quickly and serve your customers with a service that does not get delayed or consumes a lot of your customer’s time. When you provide such quick services to your audience, it puts you in their good books, thus helping you run your business smoothly and efficiently.

Moreover, if you are not too keen on sending your customers to a third-party gateway, you can use their option to accept payments on your website itself.

In addition, as a user, you are also provided with a virtual dashboard where you can easily store customer information/profiles, view reports, and also set user permissions.

Pricing: There are no hidden costs associated with this tool. The platform charges $0.20 per credit card transaction or $20 on a monthly basis for online payments.

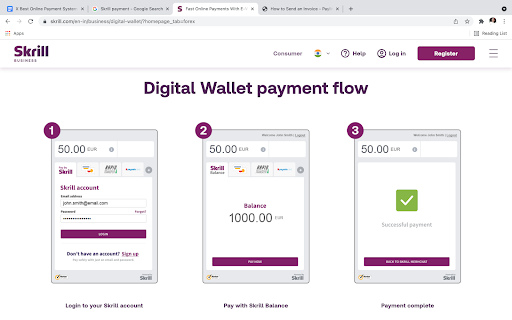

34. Skrill

For those who don’t find PayPal as convenient (though it’s hard to believe, given the ease of use that comes with PayPal), Skrill is the best alternative you can find.

Skrill provides users with instant and easy online payment services. Thanks to its powerful features like quick deposits and personal messaging, exclusive offers, and loyalty programs, Skrill helps businesses provide efficient ways to their customers to make online purchases less troublesome and more hassle-free.

Additionally, Skrill provides solutions that are tailored to meet the needs and requirements of specific businesses across different industries.

Because of their partnership with all of the major eCommerce platforms, online businesses can easily integrate Skrill with their checkout page. Whether it’s using cards, digital wallets, or instant bank transfers, you can do it all with Skrill.

To make the experience even better, you can activate the one-tap feature that Skrill provides for repeat payments. The single touch payment further makes the entire customer journey shorter and boosts the user experience.

If you wish for your customers to keep coming back, getting Skrill would perhaps be an excellent move.

Pricing: Please contact their customer service team to get an estimated quote based on your business needs.

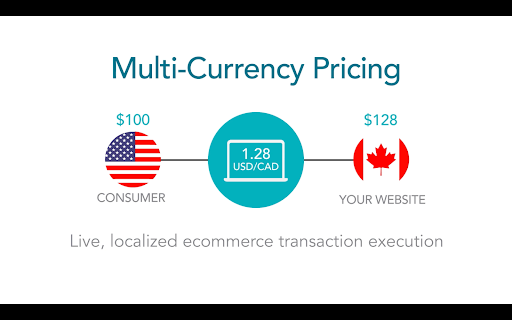

35. Moneris Solutions

A US and Canada-based company, Moneris Solutions is the best bill payment method for businesses in different sectors. This platform has proven to be effective for businesses in retail, restaurant, professional practice, enterprises, trading, and even non-profit industries.

Being the number one payment processing platform in Canada, Moneris partakes approximately 3.5 billion transactions on a yearly basis, spread across more than 35,000 merchant locations.

Moneris Solutions provide scalability for businesses. As you grow, the payment processor grows with you and can be tailored to meet your growing demand. Their customer service team is available 24/7, which makes it possible to reach out to them at any hour of the day. This helps remove the time barrier and make the process smooth.

Moneris is a safe, reliable, and easy-to-use payment processing system, allowing businesses to get payment ready, even from their international clients. All thanks to the multi pricing feature.

You can also opt for gift card offerings to add additional features to your checkout page.

Pricing: You can check out their pricing model on their website.

36. Apple Pay

ApplePay is perhaps among the widely used methods for receiving payment online. Owned and operated by a renowned technology company named Apple, Apple Pay is a secure digital wallet that makes payment safe and fast.

Apple Pay stands out from others in the crowd because of its finger touch feature. Yes, you can literally conduct transactions using Apple’s Touch ID confirmation.

All your customers will have to do to pay for your product is use their fingerprint. This adds to the convenience of paying and makes the payment process more speedy.

Apple Pay replaces the need to keep credit cards or debit cards around when making a payment. This helps reduce the number of abandoned carts and boost up your sales.

With built-in privacy an security features, it is also among the most-trusted methods of payment for many locals all over the world.

Moreover, Apple Pay comes built into all the Apple products, ranging from mobile phones to Apple Mac, Watch, and even iPad.

Pricing: There is no setup or transaction fee associated with Apple Pay.

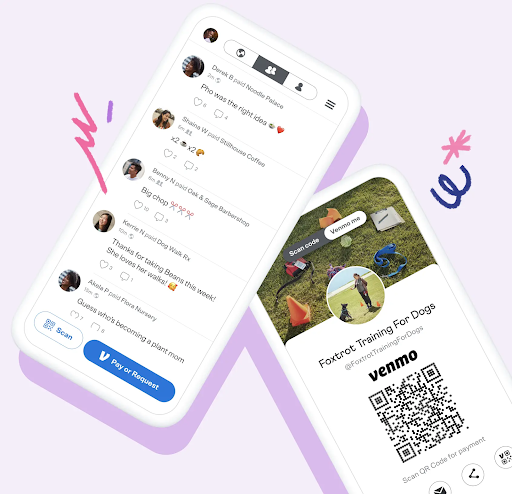

37. Venmo

Venmo is another one of the payment websites that has been acquired by PayPal. However, it is still a tool that follows very different principles and offers a variety of features.

While PayPal is for regular transactions, Venmo is considered to be a tool perfect for those who are social spenders. In this tool, you have an online feed. This means that whenever a friend pays a friend back, it gets shared publicly.

So, we can say that Venmo is a combination of a payment processor and a social platform like Facebook.

Venmo also makes it easy to split the bill. So, suppose you are a restaurant. If you use Venmo, it will make it easier for your guests to split their food bills. They won’t need a calculator to figure out who owes what. This makes the overall experience more heartwarming.

Additionally, if you are a business owner that accepts payment in cryptocurrencies too, Venmo could just be the right choice. With Venmo, you can accept payments in a variety of cryptocurrencies.

Venmo makes it easy for you to grow your business.

Pricing: Click here to find your answers related to the account fees.

Conclusion

To conclude, we can say that businesses are truly spoilt for choice when it comes to selecting their payment sites for processing purchases. Which one is the best online bill payment? It clearly depends on the features needed by a business to align its system with its ultimate goals.

However, there are a few common features that your payment processor must provide the users with and these include secure, instant, and easy transactions. The safer and quicker the transactions, the easier it will be for your customers to instill their trust in you.

Hence, you must go through the features and pricing models provided by your top choices of online payment systems and choose the one that best suits your needs.